As part of my commitment to providing comprehensive yet discerning coverage of Africa’s diverse and complex screen landscapes, I periodically analyze my own reporting to uncover country focus gaps as well as potential industry trends that might not be immediately apparent. Having conducted a first such analysis just after Q1 2024, this second examination includes coverage from all of 2024, through December 15.

In the future, subscribers can expect one or two of these self-analytical pieces annually.

It’s important to note that this is based on carefully curated coverage from the vast amount of information I receive daily, balancing relevance, significance, and diversity of voices. I believe that a key aspect of Akoroko Premium that subscribers value is this thoughtful approach and objectivity.

Ultimately, my coverage is shaped by the realities of African screen sectors. Some countries are more prolific or have greater international visibility than others, which naturally influences the frequency of their appearance in my reporting.

This analysis takes these factors into account to provide insights that reflect both the current state of African film and TV environments and my own editorial approach.

With all that in mind…

Mapping the African Sreen Landscape

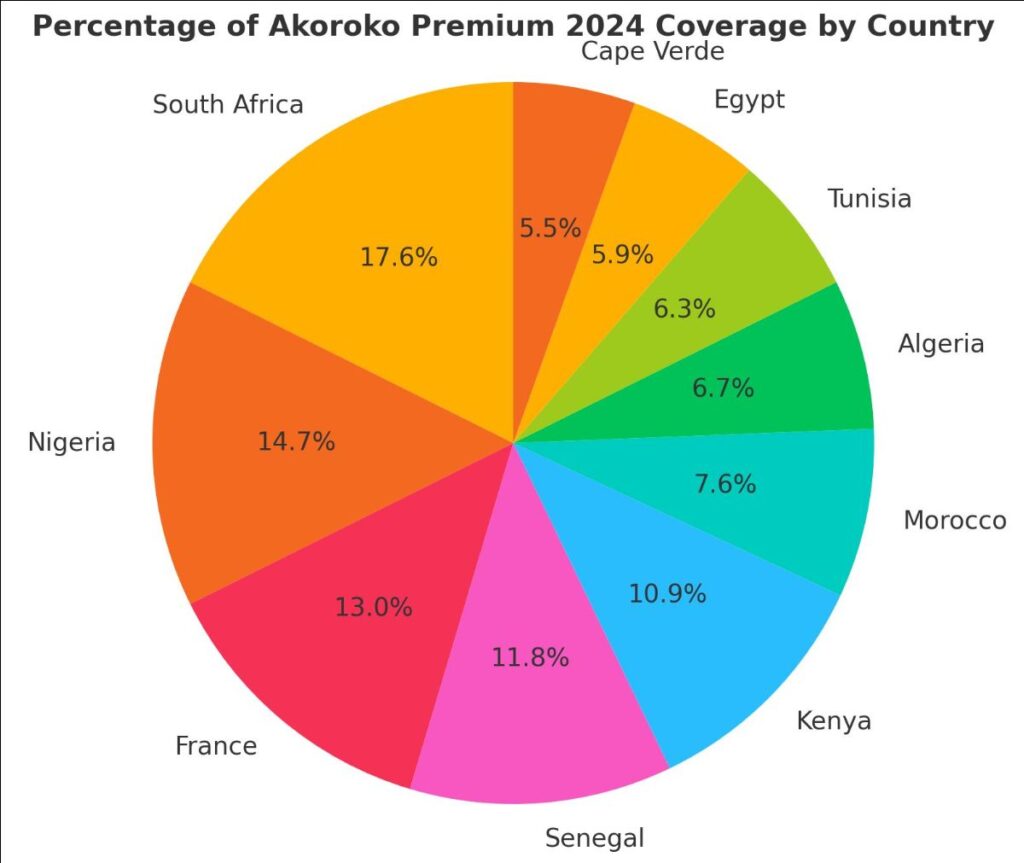

Based on analysis of approximately 660 unique newsletters published between January 1, 2024 and December 15, 2024, patterns reveal themselves in both industry activity and my coverage.

The data indicates varying levels of industry development across the continent, with individual countries pursuing different strategies to grow amid distinct regional dynamics including industry size, funding sources, audiences, languages, and international connections.

Overall, there should be little of surprise to anyone familiar with the broader landscape Akoroko Premium subscribers!

- South Africa: Akoroko Premium newsletters about South Africa covered industry infrastructure (film permits, studio developments), corporate developments (particularly the ongoing MultiChoice/Canal+ negotiations), content initiatives across film and television (including local series development and international co-productions), policy developments (streaming regulations, rebate policies), festival presence, and distribution deals. The stories point to an industry working to strike a balance between expanding commercial reach and market size while also investing in high-quality, diverse local content, at the same time dealing with what MultiChoice called “the most challenging operating conditions in almost 40 years.”

- Nigeria: My Nigeria 2024 coverage was spread across streaming platform developments (Netflix, Prime Video, Showmax), festival selections (particularly at TIFF), new production ventures (including Moses Babatope’s Nile Entertainment Media launch), international co-productions, and increasing focus on genre diversification. Headlines tracked both commercial developments and critical recognition, suggesting an industry expanding beyond traditional markets while developing new forms (narratively, stylistically, etc.) of content.

- France: The only non-African country on the list, French coverage, and high ranking should not be a surprise. It speaks to persistent post-colonial relationships with African countries, and African cinema more specifically, though in evolving forms. Beyond expected film festival coverage, notably an increased presence at the 2024 Cannes Film Festival and accompanying Marché du film, newsletters captured ongoing funding initiatives, co-production activities, sales and distribution relationships, and also a few retrospective screenings of African classics. This coverage pattern prompts considerations on the nature of international cultural and economic relationships in contemporary African cinema.

- Senegal: Senegalese stories tracked Mati Diop’s “Dahomey” from Berlinale through its return “home,” policy changes under the new government, led by President Bassirou Diomaye Faye who has been vocal about a local media landscape transformation. Additionally, retrospective coverage (particularly of Ousmane Sembène’s works), new productions, and Senegal’s consistent even if limited global festival presence. Coverage reflected both contemporary developments and engagement with cinematic heritage.

- Kenya: Kenya newsletters covered content regulation debates, film sector partnerships (particularly foreign), hosting of continental initiatives (Secretariat of the African AudioVisual Cinema Commission-AACC), new productions, market development, and talent initiatives. The stories suggest an industry actively engaging with both creative and structural development.

- Egypt: For all intents and purposes, it’s North Africa’s screen powerhouse. It has a unique historical position as one of Africa’s oldest and most established film industries, with major studio infrastructure dating back to the early 20th century. Stories included preservation efforts (digitizing the Misr Cinematic Journal), new productions, and presence in the global film marketplace, both completed films launching at major festivals and in-development projects at various script-to-screen initiatives, including an increased focus on women filmmakers.

After examining the six most covered countries above, the remaining analysis groups countries (in descending order of coverage frequency) that share certain industry characteristics or regional dynamics. This allows for better understanding of how different parts of Africa’s screen sectors evolved during this period, while maintaining focus on what the newsletters actually tell us.

7. Historical Foundations and Contemporary Currents (Morocco, Algeria, Tunisia): Speaking of the North African region, Morocco newsletters tracked its international film festival and market presence, including its Oscar submission, Nabil Ayouch’s “Everybody Loves Touda,” which bowed at Cannes. Also, guest of honor status at CineEurope 2024, and continued positioning as an international production services hub. Stories also covered documentary productions exploring cultural connections with Senegal and engagement with platforms for global distribution.

Meanwhile, Algeria coverage also centered on its international film festival and market presence, archival film issues around its independence, and new productions examining colonial history. Stories also tracked new co-production ventures and filmmakers tackling historical themes.

And Tunisia newsletters also mostly focused on international film festival and market presence, subsequent distribution deals, new co-production ventures, industry infrastructure development, and emerging filmmaker support. Coverage suggested an industry balancing international presence with domestic development.

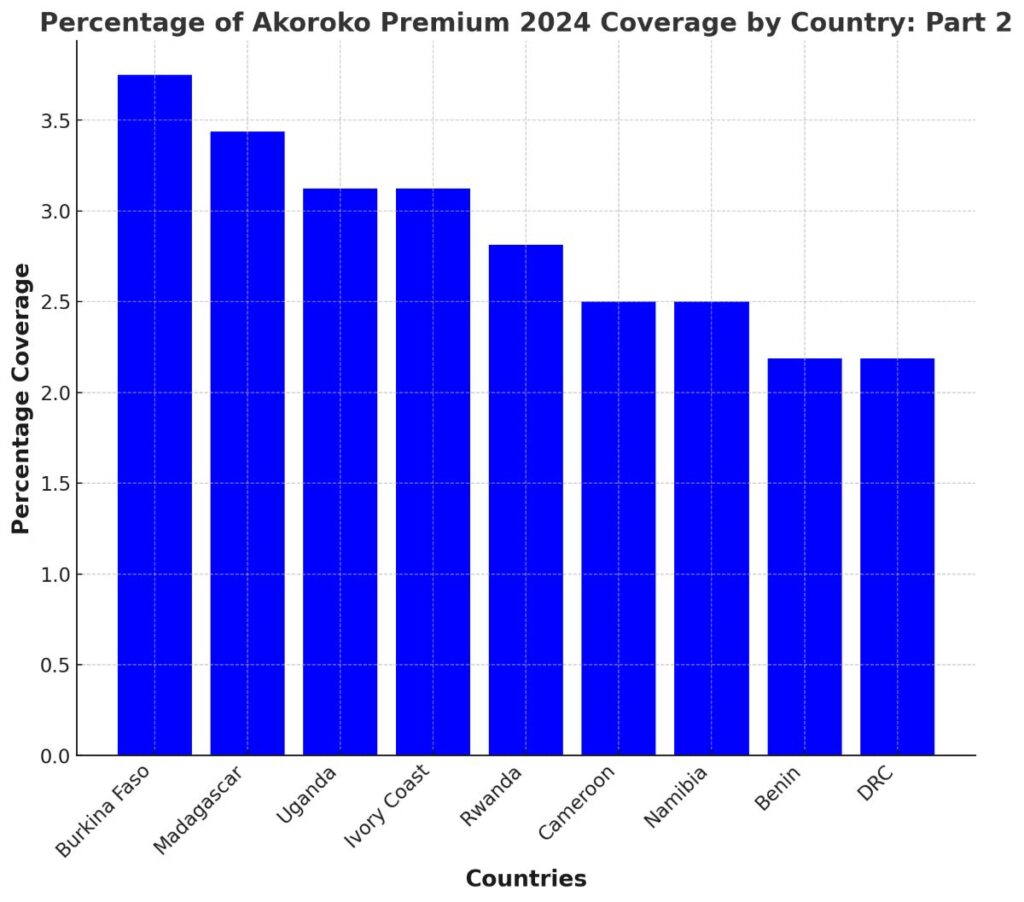

8. Island Nations and Regional Evolution (Cape Verde, Burkina Faso, Madagascar): Cape Verde’s coverage included the launch of its first film school, local film festival development, increased though still limited international co-productions, and strategic positioning within Lusophone cinema. Newsletters tracked both institutional development and creative projects.

Burkina Faso stories focused on FESPACO preparations, industry challenges amid regional instability, children’s cinema initiatives led by Apolline Traoré, and preservation of classic works like Idrissa Ouédraogo’s “Samba Traoré.”

Madagascar newsletters tracked Luck Razanajaona’s “Disco Afrika: A Malagasy Story” from festivals to very rare local distribution, new co-production initiatives, development of animation sector capabilities, and efforts to build sustainable industry infrastructure.

9. Strategic Industry Development (Uganda, Ivory Coast): Uganda’s coverage included historical documentation (“A History of Film in Uganda”), recovery of cultural artifacts from Cambridge, training initiatives, and industry development efforts. Stories suggest systematic attempts to build both infrastructure and cultural memory.

Ivory Coast newsletters focused on increased attention to VFX training programs (“Afro VFX”), box office reporting infrastructure development, increase in hyperlocal streaming platforms (EKEflicks), and new production initiatives. Coverage tracked both technical capacity building and market development.

10. Regional Transformation Efforts (Rwanda, Cameroon, Namibia, Benin, DRC): Rwanda newsletters chronicled mostly market development including the Masharket initiative, training programs, and strategic East African industry positioning. Coverage suggests a hyper-focus on letting market forces and commercial incentives drive its growth and development.

Cameroon stories tracked infrastructure development (particularly Jean-Pierre Bekolo’s Zili Jungle Studio), filmmaker development programs through Yaoundé Film Lab, and new production initiatives.

Namibia coverage included focus on its $27M film fund launch, top-tier web series initiatives as training grounds, industry leadership changes, and emerging co-production activity. Collectively, they suggest a very methodical effort in industry development.

Benin newsletters split between international-local productions (including “No Chains, No Masters”), broad cultural heritage initiatives, and ongoing effects to develop a local market. Coverage tracked both creative and infrastructural development.

DRC’s very limited stories included attention to women-focused film festivals (CINEF), documentary productions about artists like Freddy Tsimba, and international collaborations. Still an evolving, inconsistent market.

Conclusion: What 600+ Newsletters Tell Us

First, I should once again note that while I recognize my best efforts to maintain an objective lens, the natural variability in industry activity levels across different countries can inadvertently lead to my coverage being skewed towards the most active areas.

To address this, I will continue to make a concerted effort to more proactively identify and highlight developments happening in areas that typically receive less coverage and attention. By doing so, I strive to paint a fuller and more balanced picture of the continent’s dynamic screen media landscape.

That said…

- Festival Presence: Much coverage was driven by film festivals. North African films have an established presence, particularly at top European festivals, while other African regions are gaining traction at a more diverse range of festivals. This suggests both the strength of North African cinema and increasing global recognition for films from sub-Saharan Africa.

- Corporate Activity: The complex interplay between global streaming platforms, major African media companies, and local players is driving a lot of industry activity and interest. The negotiations between MultiChoice and Canal+ are particularly pivotal. The level of streaming engagement continues to vary significantly between countries.

- Policy Frameworks: Governments across Africa are paying increasing attention to the film and TV sectors, enacting new regulations, film funds and other support mechanisms. However, the policy landscape is still quite fragmented and uneven between countries. Monitoring policy developments will be key to understanding industry trends.

- Industry-Building Models: Countries are pursuing quite distinct strategies to develop their film and media industries, from Rwanda’s market-driven approach to Kenya’s focus on content partnerships to Nigeria’s balancing of business interests and creative growth. This diversity of models reflects the continent’s varied market conditions, cultural contexts and resource availability.

The analysis also emphasizes the need to look beyond international headline-generating developments to also track lower-profile but locally significant activity in smaller/developing industries.

In conclusion, I see a complex, varied, and dynamic African screen media landscape where clear trends continue to emerge: the importance of international festivals, the growing impact of streaming platforms, increased government attention to policy frameworks, and the pursuit of distinct industry-building models in different countries and broader regions.

- Future Outlook: Looking ahead, key areas to watch in 2025 and beyond include the evolution of streaming strategies (and not just for Netflix and Showmax), the development of regional production and distribution networks (still a major challenge), and the impact of new funding initiatives (unprecedented amount announced in 2024).

Despite the diversity of contexts and approaches to developing film and television sectors across the continent, Africa’s screen media environment as a whole shows much creative vitality, even as its potential remains woefully untapped!

While persistent challenges remain, there are clear signs that the landscape is beginning to turn its focus inward, cultivating local talent, stories, and audiences as foundational. With an eye towards the future, African cinema and TV sectors, collectively, are much better positioned—than ever before perhaps—for continued expansion and transformation in the coming years.

I’m optimistic.

**Start 2025 with Akoroko Premium—Free for 7 Days!**

For January 2025, access thoughtful and comprehensive insights into African film, TV, and digital ecosystems—trusted by media professionals worldwide: filmmakers, producers, distributors, programmers, curators, festival directors, scholars, financiers, and more.

Join a global subscriber base spanning North & South America, Europe, Africa, and Australia.

You will receive a daily email newsletter that may include:

– Timely news, reviews, and market analysis

– Exclusive interviews

– In-depth, incisive articles spotting trends and patterns

– Country-specific, continental, and global perspectives

– Priority access to consultations and direct communication

– Project tracking, and more…

Plans:

– Monthly: $8/month

– Annual: $72/year

**Your free trial begins at sign-up. Cancel anytime within 7 days to avoid charges.**

This January, take the first step toward becoming part of a growing community of professionals passionate about the art and business of storytelling in the African screen context.

Sign up now at http://akoroko.com/subscribe.